Travel Insurance for Spain: Coverage for Strikes and Essential Protection

Do you need travel insurance for Spain?

When plan a trip to Spain, one question often arise: is travel insurance necessary? While not lawfully require for tourists, travel insurance for Spain is extremely recommended for several compelling reasons.

Spain, like many European destinations, have excellent healthcare facilities, but medical costs for non-residents can be substantial. Eventide with the European health insurance card (eEric)or global health insurance card ( (ifita)ilable to some travelers, coverage have significant limitations.

Healthcare considerations in Spain

Spain’s public healthcare system rank among the best in Europe, but access for tourists come with restrictions. Without proper insurance, you might face these potential expenses:

- Emergency room visits: €200 300

- Overnight hospital stay: €400 700 per night

- Medical evacuation: €20,000 50,000

- Repatriation costs: €30,000 50,000 or more

These costs highlight why comprehensive travel insurance make financial sense, particularly when policies typically cost exactly a fraction of potential medical expenses.

Beyond medical coverage

Travel insurance for Spain extend advantageously beyond healthcare protection. Comprehensive policies typically include:

Source: aging.com

- Trip cancellation / interruption coverage

- Baggage loss or delay compensation

- Flight delay reimbursement

- Personal liability protection

- Emergency assistance services

Spain experience occasional transportation strikes, severe weather events, and have areas with higher rates of pickpocketing and theft, especially in tourist hotspots like Barcelona and Madrid. These realities make travel insurance a prudent investment.

Does travel insurance cover strike?

Transportation strikes in Spain and across Europe can disrupt travel plans with little warning. Spain experiences several strikes yearly affect trains, buses, taxis, and airlines. Understand how travel insurance handle these situations is crucial for travelers.

Strike coverage in standard policies

Most comprehensive travel insurance policies offer some form of strike coverage, but with important variations and limitations:

Common strike coverage elements

-

Trip cancellation / interruption:

If a strike force you to cancel or cut short your trip, insurance may reimburse prepay, non-refundable expenses. -

Travel delay:

Coverage for additional accommodation, meals, and local transportation if strikes delay your journey beyond a specified period (typically 6 12 hours ) -

Miss connections:

Reimbursement if a strike cause you to miss a connect flight or transportation link.

Key limitations and exclusions

Strike coverage come with significant restrictions travelers must understand:

-

Foreseeable strikes:

Most policies exclude coverage for strikes announce before you purchase insurance or book your trip. -

Timing requirements:

You typically must purchase insurance 14 21 days before a strike is announced to qualify for coverage. -

Documentation:

Claims require proof that the strike straightaway cause your disruption and that no alternative transportation was available. -

Coverage caps:

Policies limit reimbursement amounts for accommodations, meals, and alternative transportation.

For example, if Spanish air traffic controllers announce a strike after you’ve purchase insurance but before your departure, you’d probably be cover for result disruptions. Notwithstanding, if the strike was announced before your insurance purchase, you’d likely have no coverage.

Recent strike patterns in Spain

Spain has experienced various transportation strikes in recent years:

- Airline strikes affect carriers like Iberia, Vueling, and Ryanair

- Rail strike impact RENFE and regional train services

- Taxi and ride-share service disruptions in major cities

- Public transportation strikes affect metro and bus systems

These strikes typically last from one day to several weeks and can occur with minimal notice, make strike coverage a valuable component of travel insurance for Spain.

Enhance your strike protection

To maximize protection against strikes when travel to Spain:

-

Purchase insurance other:

Buy coverage presently after book your trip to avoid foreseeable event exclusions. -

Consider” cancel for any reason ” cfcar )verage:

This premium option allows cancellation disregarding of strike announcements, typically reimburse 50 75 % of trip costs. -

Review policy wording cautiously:

Some insurers define strike coverage more liberally than others. -

Monitor strike announcements:

Stay informed about potential labor actions through resources likes pain’s ministry of transport website or major Spanish news outlets.

Choose the right travel insurance for Spain

Select appropriate travel insurance for Spain require balance coverage needs with budget considerations.

Essential coverage components

A suitable policy for Spain should include:

-

Medical coverage:

Minimum €30,000, rather €€100000 or more -

Emergency evacuation:

At least €100,000 in coverage -

Trip cancellation / interruption:

Coverage match your total prepay trip costs -

Baggage protection:

Sufficient to cover your belongings’ value -

Strike and travel delay coverage:

With reasonable daily allowances

Special considerations for Spain

When select insurance for Spanish travel, consider these factors:

-

Adventure activities:

If planning activities like hiking, climbing, or water sports, ensure your policy cover these. -

Regional travel:

Confirm coverage will extend to all regions you will visit, will include islands like malMallorcabiIbizar the canaries. -

Rental car protection:

Consider supplemental coverage if drive in Spain. -

Electronics coverage:

Standard policies oftentimes limit valuables protection; consider supplemental coverage for expensive cameras or devices.

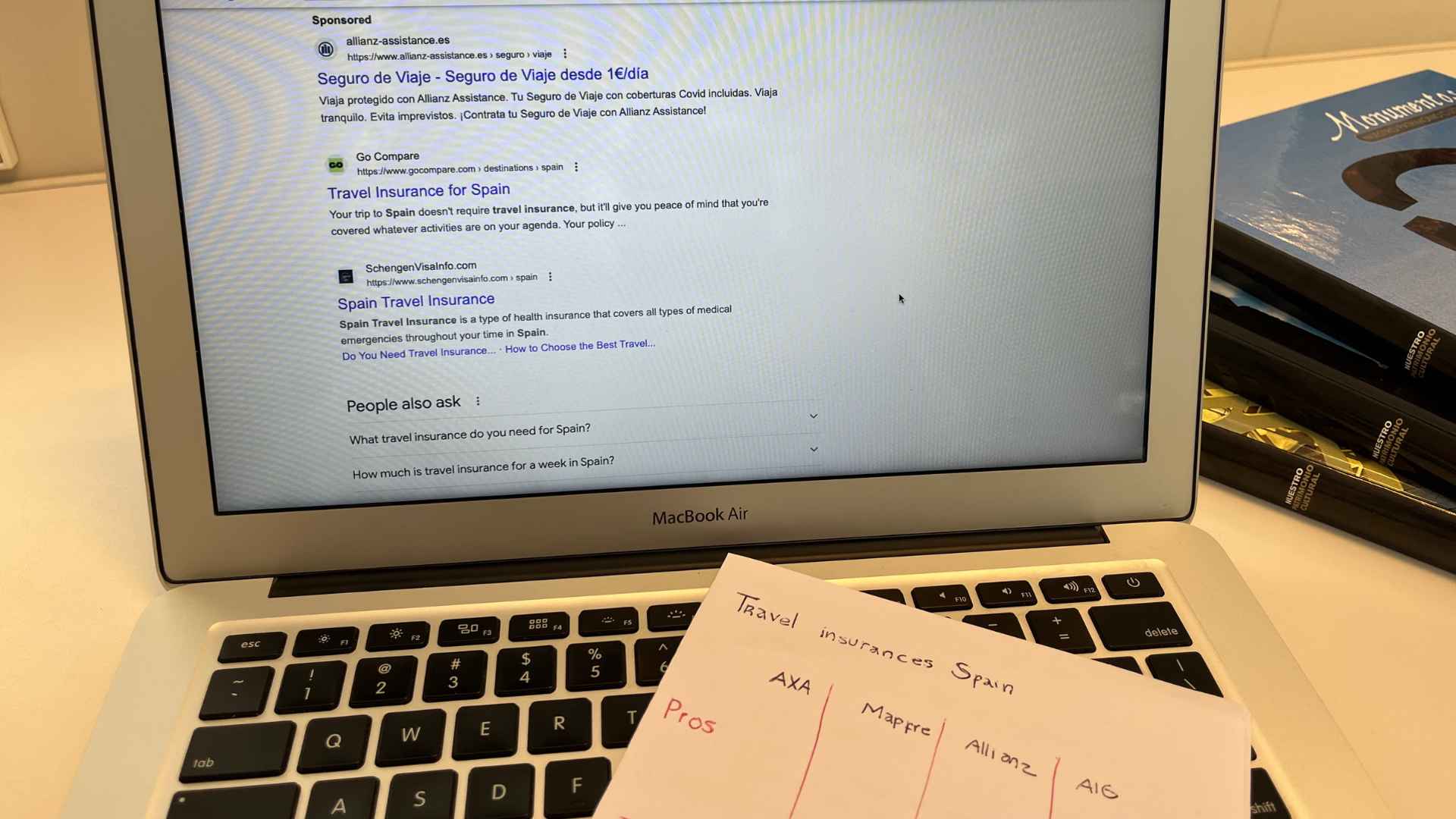

Policy comparison tips

When compare travel insurance options for Spain:

- Use comparison websites to evaluate multiple policies simultaneously

- Read the fine print regard strike coverage and exclusions

- Check deductible amounts and how they apply to different claim types

- Verify the insurer’s reputation for claim handling and customer service

- Ensure 24/7 emergency assistance with Spanish speak representatives

Make claims for strike relate disruptions

If your Spanish travels are affect by a strike, proper documentation importantly improve your chances of successful claims.

Essential documentation

Gather these items to support strike relate claims:

- Official statements from transportation providers confirm strike impact

- Boarding passes, tickets, and reservation confirmations

- Receipts for all additional expenses incur

- Write confirmation of cancellations or delays

- Correspondence with travel providers about alternative arrangements

- Photos or screenshots of airport / station information boards show cancellations

Claim filing process

Follow these steps when file strike relate claims:

- Contact your insurer’s emergency assistance line straightaway when disruption occur

- Follow their guidance regard alternative arrangements

- Keep detailed records of all communications

- Submit claim quickly, typically within 30 90 days of the incident

- Provide comprehensive documentation as outline above

- Respond promptly to any requests for additional information

Alternative and supplemental protection options

Beyond standard travel insurance, consider these additional protection measures for Spanish travel:

Credit card travel benefits

Many premium credit cards offer travel protections that may supplement or replace traditional insurance:

Source: insurancecoverspain.es

- Trip cancellation / interruption coverage

- Travel delay reimbursement

- Baggage delay compensation

- Rental car coverage

Notwithstanding, credit card protections typically have lower coverage limits and may not include medical coverage, which remain essential for Spain.

European health insurance card (eEric)or global health insurance card ( (ifit)

For eligible travelers, these cards provide access to state provide healthcare in Spain at the same cost as locals. Nonetheless, they have significant limitations:

- No coverage for private medical care

- No evacuation or repatriation coverage

- No coverage for nonmedical travel disruptions

- Possible upfront payment requirement with later reimbursement

These cards should supplement, not replace, comprehensive travel insurance.

Airline and tour operator protections

Under EU regulation 261/2004, travelers on flights depart from or arrive in Spain may be entitled to:

- Financial compensation for significant delays or cancellations

- Meals and accommodation during extended delays

- Rebooked on alternative flights

Notwithstanding, strikes sometimes qualify as” extraordinary circumstances ” hat exempt airlines from compensation requirements, make insurance coverage peculiarly valuable.

Conclusion: make the right insurance decision for Spain

Travel insurance for Spain represent a small investment that can prevent major financial losses and provide peace of mind. While not lawfully mandate, the potential costs of medical emergencies, trip disruptions, and strike relate complications make comprehensive coverage extremely advisable.

Strike coverage, in particular, offer valuable protection in a country where transportation disruptions occur regularly. By understand policy limitations, purchase insurance other, and maintain proper documentation, travelers can navigates pain’s occasional labor actions with minimal disruption.

The ideal approach combine comprehensive travel insurance with awareness of supplementary protections like EU passenger rights and credit card benefits. This layered strategy ensure maximum protection while explore all that Spain have to offer — from the beaches of Costa del Sol to the architecture of Barcelona and the cultural riches of Madrid.

Remember that the small upfront cost of proper travel insurance can save thousands in potential expenses and countless hours of stress should the unexpected occur during your Spanish adventure.