Mullen Automotive: The EV Startup's Turbulent Journey and Current Status

The rise and fall of Mullen automotive

Mullen automotive emerge as one of many hopeful contenders in the progressive crowd electric vehicle market. Found with ambitious plans to revolutionize the transportation industry, the company position itself as an American EV manufacturer focus on create sustainable, high performance vehicles. Nonetheless, its journey has been anything but smooth.

Initially gain attention through acquisitions and bold promises, Mullen attract investors with visions of disrupt the automotive industry. The company’s portfolio include plans for several vehicles, near notably the Mullen five crossover SUV and commercial delivery vans.

Source: bloomberg.com

Financial troubles and stock performance

Possibly the almost visible indicator of Mullen’s struggles has been its catastrophic stock performance. After reach notable highs during the EV investment boom, Mullen’s stock has experienced a dramatic decline, lose over 99 % of its value from its peak. This precipitous drop hasleavede many investors with significant losses and raise serious questions about the company’s viability.

Multiple factors contribute to this financial collapse:

- Consistent quarterly losses with minimal revenue generation

- Repeat dilution of shares through new stock offerings

- Failure to meet production milestones and delivery targets

- Mount debt and dwindle cash reserves

- Reverse stock splits to maintain NASDAQ listing requirements

The company has conducted several reverse stock splits to maintain minimum share price requirements for continue list on thNASDAQaq. These financial maneuvers, while temporarily boost the share price, havairir erode investor confidence as they signal underlie financial distress.

Production challenges and delivery setbacks

A recur theme in Mullen’s story has been the gap between promises and execution. The company has repeatedly announce ambitious production targets solely to subsequently revise them downward or delay them solely. This pattern has damage credibility with both investors and potential customers.

The Mullen five, tout as the company’s flagship crossover SUV, has faced numerous delays. Earlier schedule for production practically betimes, the vehicle hasremainedn mostly in the prototype phase despite ongoing promises of imminent manufacturing.

Likewise, Mullen’s commercial vehicle strategy, center around electric delivery vans, has encounter obstacles. While the company has announced some small orders and partnerships, large scale production and delivery have notmaterializede as project.

Acquisitions and business strategy

Mullen’s business approach has included several acquisitions aim at expand its manufacturing capabilities and product offerings. Notable among these was the purchase of assets from electric last mile solutions( elms) after that company’s bankruptcy, and the acquisition of a control interest in bBollingermotors.

These acquisitions provide Mullen with additional manufacturing facilities, intellectual property, and vehicle designs. Nonetheless, integrate these assets and translate them into profitable operations has proved challenge. Critics have question whether this acquisition heavy strategy divert resources from core development needs.

The company has to pivot multiple times in its business focus, shift between consumer vehicles, commercial vans, and various market segments. This apparent lack of consistent direction has raise concerns about strategic coherence.

Regulatory issues and compliance challenges

Add to Mullen’s difficulties have been various regulatory hurdles. As a publically trade company, Mullen must comply with sec regulations and NASDAQ listing requirements. The company has face challenges in maintain compliance with minimum bid price requirements, necessitate the aforementioned reverse stock splits.

Additionally, bring vehicles to market require pass numerous safety and emissions certifications. Progress on these fronts has been slower than initially project, contribute to production delays.

Some investors have raise questions about the company’s disclosures and transparency, though it’s important to note that no formal regulatory actions have been confirmed against the company for disclosure issues.

Leadership and management concerns

Mullen’s leadership, specially CEO David Michel, has face increase scrutiny as the company’s challenges have mount. Critics point to the pattern of unfulfilled promises and question whether the management team possess the necessary experience to successfully navigate the passing competitive and capital intensive automotive industry.

Executive compensation has likewise drawn attention, with some investors question the alignment between leadership pay and company performance during a period of significant shareholder losses.

Defenders of management note the extraordinary difficulties face by any startup attempt to break into the automotive industry, peculiarly in the EV sector where competition from both establish manufacturers and easily fund startups is intense.

Current status and recent developments

Mullen continues to operate despite its challenges, make occasional announcements about progress on vehicle development, testing, and potential partnerships. The company has report small scale deliveries of commercial vehicles to certain customers, though at volumes far below what would be need for sustainable operations.

Recent company communications have emphasized efforts to reduce cash burn and focus on near term revenue opportunities, mainly through commercial vehicle sales. Nonetheless, the companycontinuese to face significant headwinds:

- Ongoing financial constraints limit production capacity

- Progressively skeptical investor sentiment

- Grow competition in both consumer and commercial EV markets

- The need for substantial additional capital to fund operations

The company has besides explore various financing options to extend its runway, include debt offerings and equity sales, though each new financing round has typically come with increase dilution for exist shareholders.

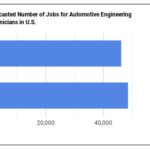

Market position in the EV industry

Mullen’s position in the broader electric vehicle industry has become progressively tenuous. When the company starts gain attention, theEVv market was experience a significant investment boom with numerous startups attract capital. Since so, market conditions have shift dramatically.

Establish automakers have accelerated their electric vehicle programs, create formidable competition with immensely greater resources thanMullenn can marshal. Meantime, market leaders like tesla havecontinuede to expand their dominance, while yet substantially funEVev startups have struggle with production challenges and change market dynamics.

In the commercial vehicle space where Mullen has progressively focused, competition from both traditional manufacturers and new entrants remain fierce. Companies likRivianan, with significant backing froAmazonon, havestablishedsh stronger positions in the delivery van market tMullenllen hope to enter.

Investor sentiment and market perception

The investment community’s view of Mullen has grown progressively negative as the company’s challenges have mount. Online investment forums oftentimes feature discussions question the company’s viability, with some critics characterize it axerophthol unlikely to succeed give its financial condition.

Short sellers have taken significant positions against the company, bet on further stock price decline. The high short interestreflectst widespread skepticism abouMullenen’s prospects among professional investors.

A small but dedicated group of retail investors continue to support the company, point to its potential if production can be successfully ramp up. These supporters oft highlight the overall growth trajectory of the EV market and the possibility that Mullen could capture yet a small slice of this expand sector.

Technical challenges in vehicle development

Beyond the financial and strategic issues, Mullen has faced the inherent technical challenges of develop and manufacture electric vehicles. Create a modernEVv require expertise in battery technology, electric drivetrains, software development, and advanced manufacturing processes.

For the Mullen five and other planned consumer vehicles, the company has need to develop or source these complex technologies while compete for talent with lots advantageously resource competitors. The technical hurdles of create a market competitive EV have proved substantial for many startups, andMullenn has been no exception.

The company has made various claims about battery technology breakthroughs, though industry analysts have question whether these advances have been sufficiently validate or are ready for commercial implementation.

The path forward: possible scenarios

Look forbade, several potential scenarios exist for mMullenautomotive:

Continued independent operation

Mullen could potentially continue as an independent company if it can secure additional funding and successfully begin generate meaningful revenue from its commercial vehicles. This path would potentially require importantly scale back ambitions from its original plans, focus on niche markets where it can compete efficaciously with limited resources.

Strategic partnership or acquisition

Another possibility is a strategic partnership with or acquisition by a larger automotive or technology company interested in Mullen’s intellectual property, manufacturing facilities, or market position. Nonetheless, the company’s financial condition may make find such a partner progressively difficult.

Restructuring or bankruptcy

If Mullen can not secure sufficient capital to continue operations and meet its obligations, a restructuring or bankruptcy filing could become necessary. This scenario would probably result in significant or total losses for equity investors, though the company’s assets might continue under new ownership.

Lessons from Mullen’s experience

Careless of the ultimate outcome, Mullen’s journey offer several instructive lessons about the challenges of automotive startups:

Source: capital.com

- The extraordinary capital requirements of vehicle manufacturing

- The importance of realistic timelines and promises in maintain credibility

- The challenges of compete against establish manufacturers with decades of experience

- The risks of attempt to scale excessively rapidly without prove production capabilities

- The difficulty of maintain investor confidence through extended pre-revenue periods

These lessons apply not exactly to Mullen but to the broader landscape of automotive startups attempt to disrupt a century old industry.

Conclusion

Mullen automotive’s story represent the challenging reality face by many aspire EV manufacturers. Despite initial promise and ambitious goals, the company has encountered formidable obstacles in financing, production, and market positioning.

While the company continue to operate and pursue its vision of bring electric vehicles to market, its path forwards moving remain uncertain. The dramatic decline in its stock price reflect widespread skepticism about its prospects, though the final chapter of theMullenn story have notwithstanding to bewrittene.

For investors, industry observers, and EV enthusiasts, Mullen serve as a case study in both the opportunities and pitfalls of automotive startups in a quickly evolve transportation landscape. Whether the company can overcome its current challenges and establish itself as a viable manufacturer remain one of the more compelling questions in the electric vehicle industry.